General

The Expert Advisor "Night Hunter Pro" is a night scalper that tries to make small profits during the night. The use of night scalpers can be very risky, it can even get "out of control". Especially at night, due to lack of liquidity, large jumps in price can occur, which can lead to large drawdown. This can result in large differences between real results and backtest results, especially for a night scalper. Therefore, a broker with very low spreads is absolutely necessary, such as IC Markets.

Furthermore, the buyer should be aware of the fact that the provider uses psychological selling strategies, especially "shortage". With the help of this strategy, the buyer is pressured not to miss the "offer".

The vendor claims that it has been successfully using the strategy applied to the Night Hunter Pro for years. Unfortunately, we cannot judge to what extent this statement is true. After all, the live signals were released in October 2020.

On the positive side, we noticed that the seller does not use any dangerous strategies with Night Hunter Pro, in addition, the Expert Advisor is supposed to be FIFO compatible and use stop loss on every trade. Furthermore, we liked the comprehensive user manual.

At the time of writing our review (03/03/2022), Night Hunter Pro had a total of 48 reviews with an average of 4.84 stars awarded. We noticed that a relatively large number of reviews were made by buyers with a rather low rating (rating < 100). This may indicate that many buyers have a low experience in algorithmic trading. Otherwise, we did not notice any other peculiarities.

Live signals

To verify the trading results, the provider has published several live signals. The results of the live signals are quite positive. Nevertheless, we noticed some peculiarities.

All signals have a balance of only a few hundred USD (converted) or less. The question arises why the provider does not trade with larger balances. If you want to make money and also have confidence in your own Expert Advisor, a significantly larger balance should not be a problem.

Furthermore, most trades have a lot size between 0.01 and 0.03. With a Night Scalper, which is generally used with low liquidity and can therefore react very unstable and sensitive to certain market situations, can possibly be successful with a small lot size. With a significantly larger lot size, however, it may fail. Therefore, it would be desirable if the provider would show live signals with significantly larger balance and lot size. Thus, the performance can be analyzed even for larger forex accounts. Therefore, it is not apparent from the provider's live signals whether the Expert Advisor is also profitable with significantly larger lot sizes.

Additionally, it is evident from the results of the live signals that Night Hunter Pro opens trades rather rarely. This fact can lead to the case that a single large loss ensures that a long time is needed (often many months) to make up for this single loss.

Live signals of the provider:

- Night Hunter Pro Best Pairs

- Night Hunter Pro MT5 Extreme

- Night Hunter Pepper

- Night Hunter Pro All Pairs

- Night Hunter Pro Rann

- Night Hunter Pro FIFO Rules

- Night Hunter Best Pairs MinPriceRange 15

Profile of the provider on myfxbook.com with live signals of the Expert Advisor: MischenkoValeria trader's profile

Backtests

The backtests were created for the maximum available period (2003 – 2022). The following supported currency pairs with lot size = 0.01 were considered:

All supported currency pairs: GBPUSD, EURUSD, EURCHF, USDCAD, USDCHF, CHFJPY, AUDCAD, EURCAD, EURAUD.

The backtest procedure and all necessary settings are described in detail here. According to the provider, no set files are required for the backtests, as all necessary settings are available internally in the Expert Advisor. It should be noted that the profitability of Night Hunter Pro is very strongly dependent on the spread, so that the following results should be treated with caution.

All Backtest Results

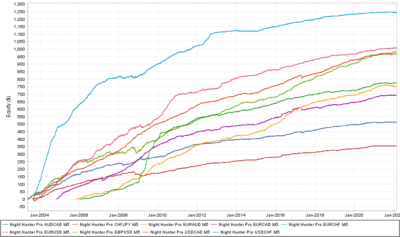

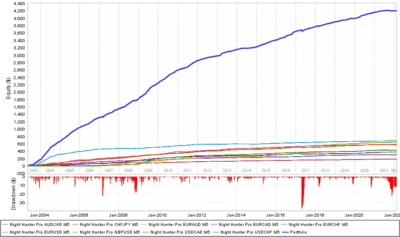

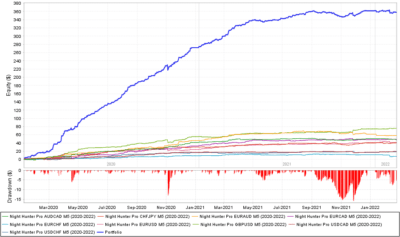

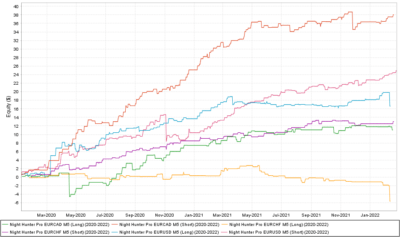

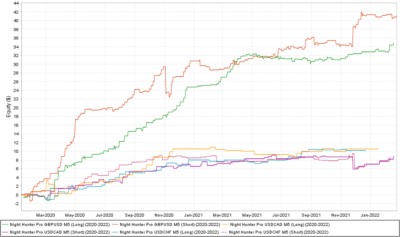

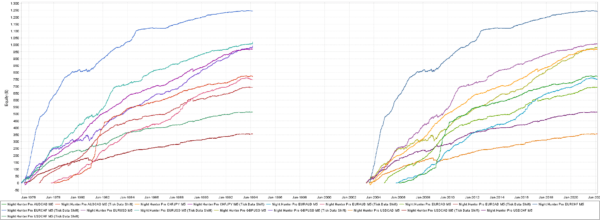

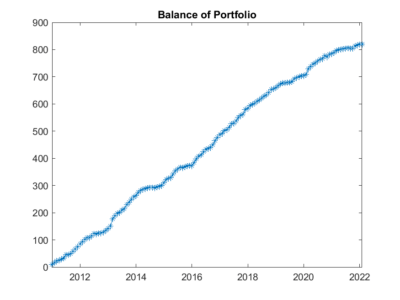

The figures below show the equity of the backtests of all currency pairs for the period 2003 – 2022.

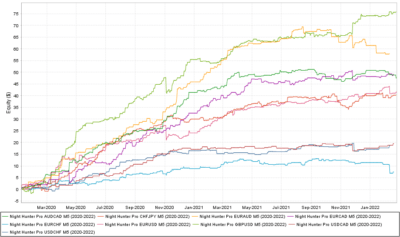

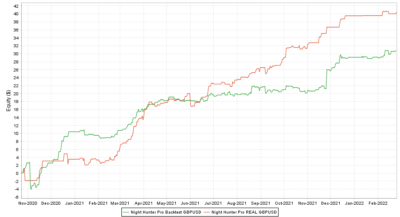

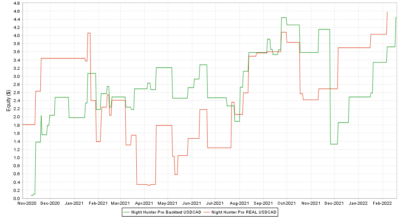

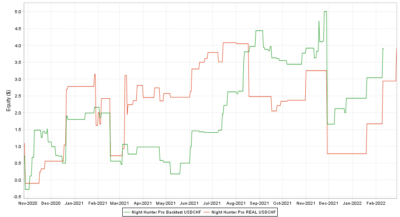

Since the final years of backtest results are particularly relevant to the analysis, the figures below show the period 2020 – 2022.

Both the backtest results and the provider's live signals show that only two of the nine supported currency pairs are profitable. The remaining seven currency pairs are profitable until 2021, but seem to show saturation from 2021 onwards and are therefore no longer profitable from 2021 onwards.

Possible reasons for saturation can be overfitting, a long-term change in the market situation or even relevant adjustments to the forex account on the part of the broker.

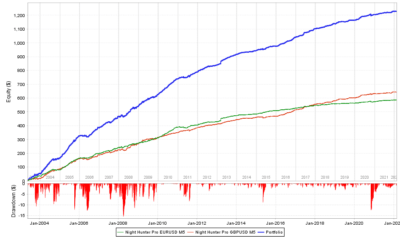

In our opinion, the following currency pairs can be considered profitable.

Profitable currency pairs: EURUSD, GBPUSD

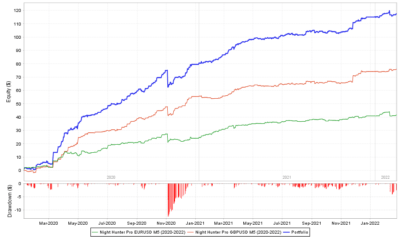

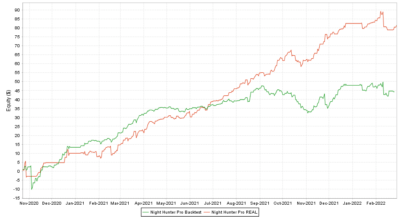

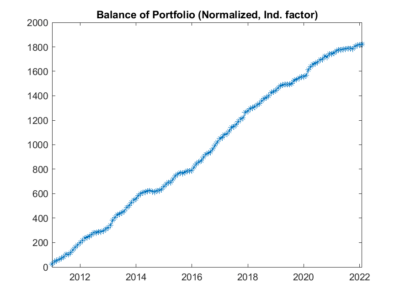

The figures below show the equity of profitable currency pairs for the periods 2003 – 2022 (left) and 2020 – 2022 (right).

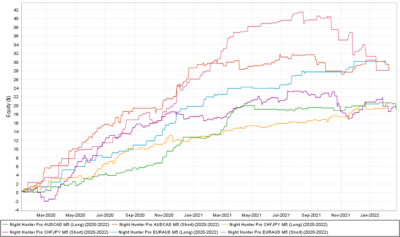

Furthermore, we have considered the individual strategies depending on the trading direction (long and short). This consideration has revealed further profitable currency pairs or strategies.

Results depending on the direction

The consideration of the strategies depending on the trading direction (long and short) has revealed further profitable currency pairs or strategies. Due to the fact that the Expert Advisor rather rarely opens trades, one should act rather cautiously here.

Profitable currency pairs depending on the direction (long and short): CHFJPY Long, EURAUD Long, EURCHF Short, EURUSD Long + Short, GBPUSD Long + Short

The figures below show the currency pairs depending on the direction (long and short) for the period 2020 – 2022.

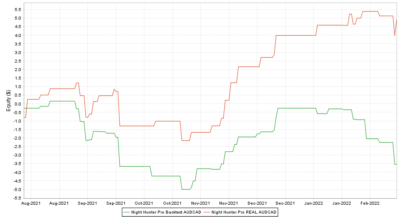

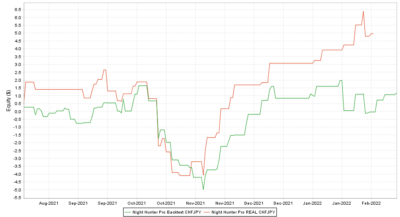

Comparison between backtest and live signal

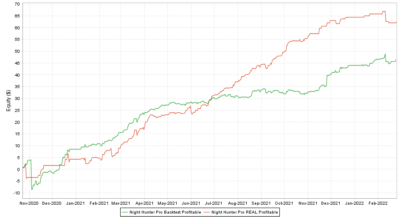

To verify the validity of the backtests, we compared the backtest results with the live signals. For the comparison we used the live signal "Night Hunter Pro All Pairs" (links: MQL5, Myfxbook). The comparisons must be viewed with caution, as the live signal is managed in AUD currency and the backtests were created in USD currency. Nevertheless, the AUD/USD currency pair fluctuates by only about 5% in the period under consideration and should only slightly influence the comparison.

Comparison between single currencies

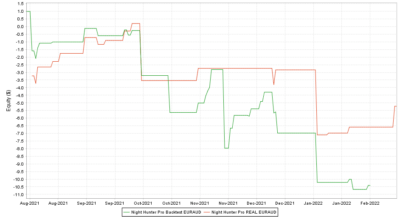

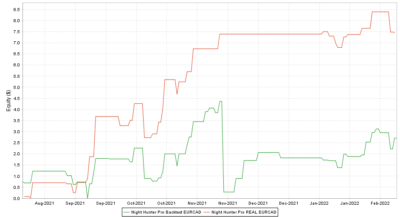

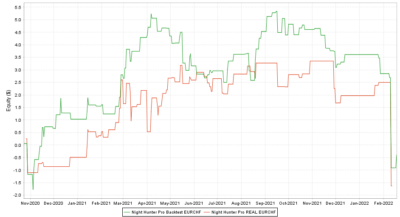

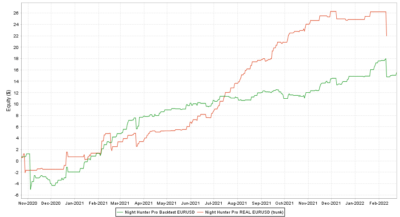

The figures below show the comparison between backtest and live signal for each currency.

Comparison between portfolios

The figures below show the comparison between backtest and live signal respectively regarding the portfolios with all and profitable currencies.

Tick Data Shift

To detect possible fraud, we created backtests with tick data shifted into the past (Tick Data Shift). The comparison of the backtest results with and without tick data shift shows that they are almost identical.

Raw backtest results

We have tested with the lot size = 0.01.

In the backtest reports shown below, we have removed the individual trades for better presentation and readability. You can download the uncut raw reports as a zip file.

Complete raw Backtest reports without truncation: Night_Hunter_Pro_Backtest_Reports_2022_03_03.zip

Click on one of the tabs below to open the corresponding backtest. The backtest results are best viewed on high-resolution screens.

-

Night Hunter Pro AUDCAD M5

-

Night Hunter Pro CHFJPY M5

-

Night Hunter Pro EURAUD M5

-

Night Hunter Pro EURCAD M5

-

Night Hunter Pro EURCHF M5

-

Night Hunter Pro EURUSD M5

-

Night Hunter Pro GBPUSD M5

-

Night Hunter Pro USDCAD M5

-

Night Hunter Pro USDCHF M5

Statistical analysis

We will apply the analysis exclusively to the backtest results from 2011. Additionally, we will only include the currency pairs that we believe are profitable.

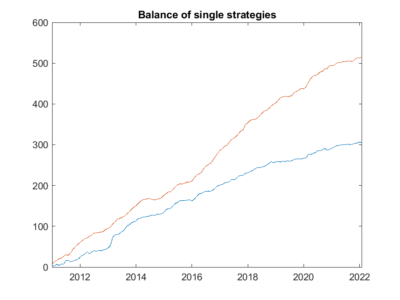

Single strategies (balance and statistical results)

The two following figures show the single strategy balances with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balance results of the left and right figure are irrelevant, what counts is that the balance of the strategies with higher risk and higher correlation is weighted lower.

| Setfile | Sortino Ratio | Downside Deviation | Independence Factor |

|---|---|---|---|

| Night Hunter Pro EURUSD M5 | 2.655 | 0.857 | 1 |

| Night Hunter Pro GBPUSD M5 | 10.932 | 0.351 | 1 |

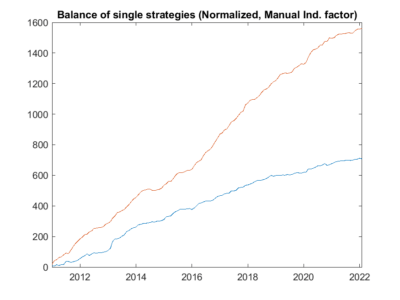

Portfolio (balance and statistical results)

The two following figures show the portfolio balances with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balance result of the left and right figure is irrelevant, what counts are the slightly smoother balance curve and the statistics.

| Portfolio related factors (on monthly basis) | Unweighted | Weighted | Improvement |

|---|---|---|---|

| Sortino ratio | 11.368 | 14.716 | 29.5 % |

| Return/Drawdown ratio | 65.469 | 70.323 | 7.4 % |

| Calmar ratio | 0.489 | 0.525 | 7.4 % |

Weighted: Downside Deviation and Independence factor

Final assessment

Night Hunter Pro seems to be a stable Expert Advisor. However, it should be noted that Night Scalper can quickly show unpredictable results due to low liquidity. A broker with very low spreads is absolutely necessary, such as IC Markets. Also, the Expert Advisor opens trades rather infrequently, i.e. it has a lower number of trades per time unit compared to other Expert Advisors. The live signals published by the provider indicate that Night Hunter Pro is profitable, but only for small lot sizes (0.01 – 0.03). With the results shown, it is not apparent how the EA behaves with larger lot sizes and whether it is still profitable then. Based on the backtest results we performed, only two strategies/currency pairs are profitable. In our opinion, Night Hunter Pro is profitable. However, the price seems too high to us, based on the criticisms already mentioned.

waaah so details ahh your 'review'

it would help a lot lot of peoples….thanks i really appreciate it.thanks again

ooh my goodness what is this please?? I have never seen such an awesome review!

hi, I would like to know why would you think only gu and eu are profitable pair?