Our opinion about the Expert Advisor

We noticed positively that the seller does not use psychological sales strategies. Stenvall Invest contains several strategies, but according to the seller, no dangerous strategies are used. We could not find any dangerous strategies either. A special feature of the Expert Advisor is that it trades quite rarely, on average about 3.4 trades per week and that only with the EUR/USD currency pair. Furthermore, the seller has published an article with more information about the strategy (the article was not yet completed as of March 16, 2021).

The seller seems to be actively developing the Expert Advisor and has only a few products in the MQL5 Market, so he should have enough time to take care of his products. We noticed that Stenvall Invest was released on September 26, 2020, but the Live Signal has been in existence since April 2019, so this results in a difference of about 1.5 years. We do not evaluate this circumstance negatively, it is just a conspicuousness to be evaluated neutrally and may indicate that the developer has already been working on the Expert Advisor for a long time. Furthermore, we have noticed that the seller offers two very similar Expert Advisors: "Stenvall Invest" and "Alexis Stenvall". According to the seller, initially there was only "Alexis Stenvall". From this Expert Advisor, a modified version named "Stenvall Invest" was created. Later, he incorporated the modifications into "Alexis Stenvall" as well, so now there are two similar Expert Advisors. This also explains the difference of 1.5 years mentioned above. There was a live signal of "Alexis Stenvall", which is now offline. When asked why the seller took the signal offline, he explained that he tested a new feature that did not work as desired and brought a loss. As a result, the seller has taken the signal offline.

Reviews on the MQL5 Market

During the creation of our review (March 17, 2021) there were only 5 reviews of the Expert Advisor, three of them were positive, two negative. The two negative reviews were created around Christmas and New Year 2021 and can most likely be attributed to the fact that the Expert Advisor performed few or no trades during this time. Therefore, and due to the low number of ratings, the ratings have little significance overall.

Backtests

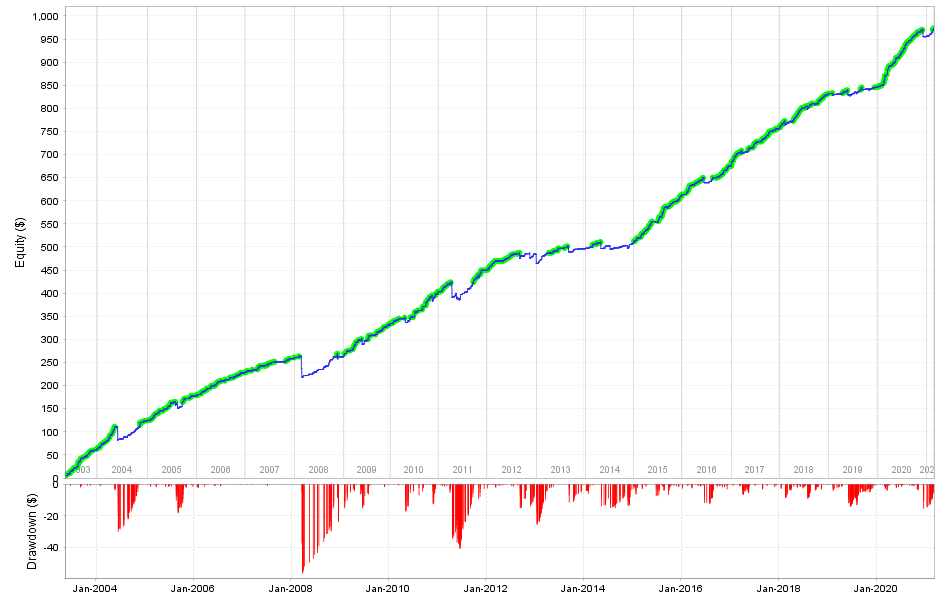

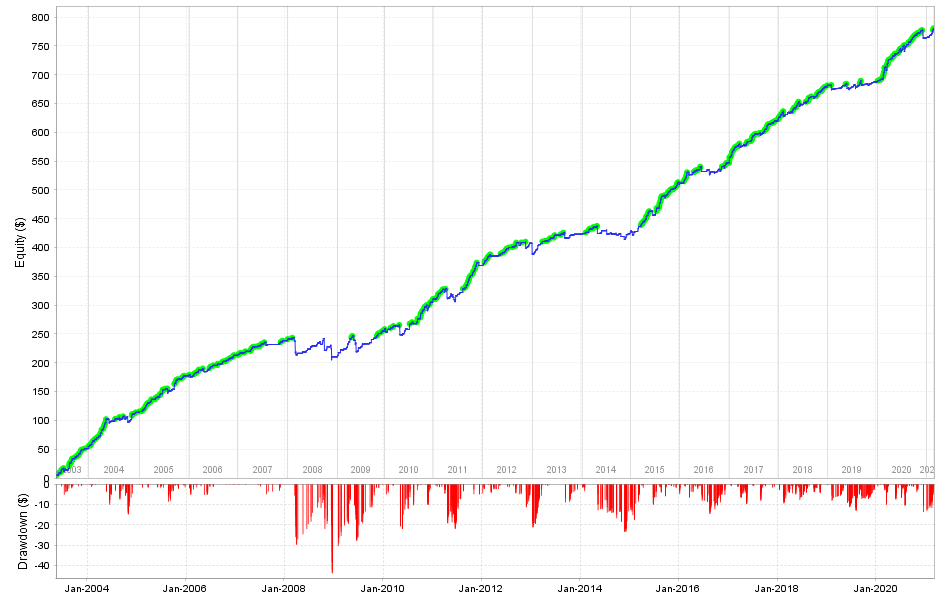

We have tested both trading modes "AUTO MODE" and "ST Protection", the results indicate profitable and stable strategies. In addition, both trading modes have a high correlation of about 64%. This results in only a very small improvement if one wants to use both trading modes in parallel in a portfolio. For those who still want to do it and for the sake of completeness, we still did the analysis regarding the portfolio and listed the statistics about it in a table below. In addition, we have tested the Expert Advisor with tick data shifted into the past (28 years) to uncover any inconsistencies. The backtests show almost identical results.

Our final assessment

Overall, we find the Expert Advisor very interesting, because it seems that quite a stable strategy is used here. The live and backtest results confirm this. We could not find any serious negative anomalies. Because the Expert Advisor rarely trades, a statistical statement about its profitability can only be made after years. Moreover, this makes the Expert Advisor interesting only for traders who are interested in long-term results only. We feel that the price is high, after all Stenvall Invest is designed for only one currency pair, so there is no diversification in terms of currency pairs. Furthermore, the seller has taken a signal of a similar Expert Advisor Alexis Stenvall offline after it achieved undesirable results. Here we would have liked the seller to leave this signal online for trust and transparency reasons and for analysis. Because this naturally gives you the feeling that the seller wants to cover up undesirable results. After all, these undesirable results only came about due to incorrect application on the part of the seller, according to the seller's statement. Even though we feel the price is high, we can definitely recommend Stenvall Invest for long-term portfolios, as it was profitable at the time of our review.

Live signals

A real signal exists since April 2019 with only 341 trades.

Raw backtest results

We have tested both trade modes "AUTO MODE" and "ST Protection" with the lot size = 0.01.

The backtest results are best viewed on high-resolution screens.

Click on one of the tabs below to open the corresponding backtest.

-

Stenvall Invest EURUSD M5 (AUTO MODE)

-

Stenvall Invest EURUSD M5 (ST Protection)

Equity chart from Quant Analyzer

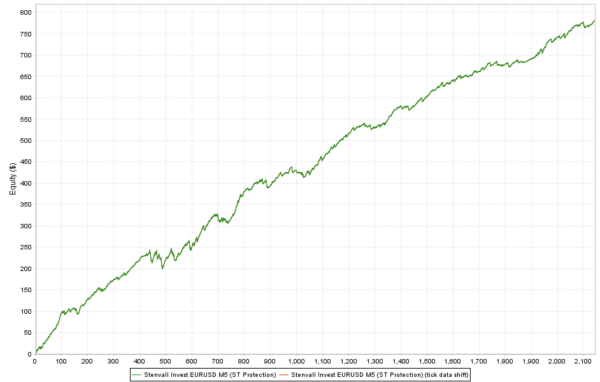

Tick data shift

We have additionally tested the Expert Advisor with tick data shifted into the past (28 years) to uncover any inconsistencies. The backtest results are almost identical. Below as an example only the Equity chart of the trading mode ST Protection.

Statistical analysis

| Setfile | Sortino Ratio | Downside Deviation | Independence Factor |

|---|---|---|---|

| Stenvall Invest EURUSD M5 (AUTO MODE) | 1.002 | 4.56 | 0.61 |

| Stenvall Invest EURUSD M5 (ST Protection) | 0.969 | 3.78 | 0.61 |

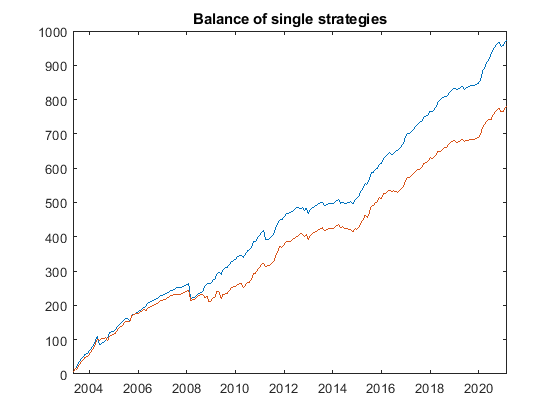

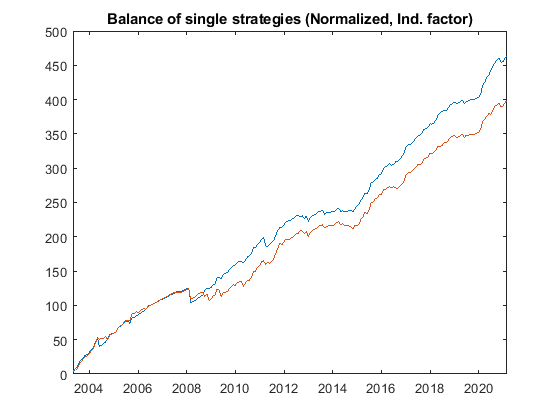

Single setfiles / strategies

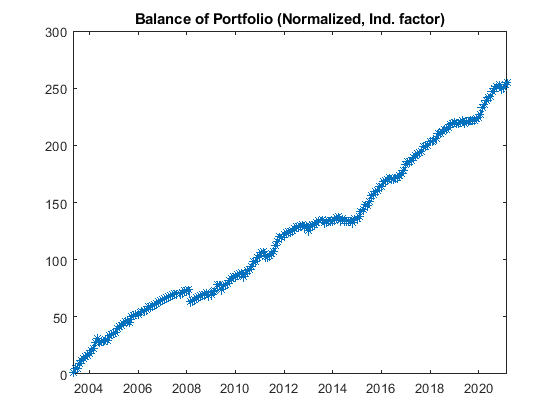

The two following figures show the single setfile or strategy results with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balances in the right curve are irrelevant, what counts is that the balance sheets with higher risk and higher correlation are weighted lower.

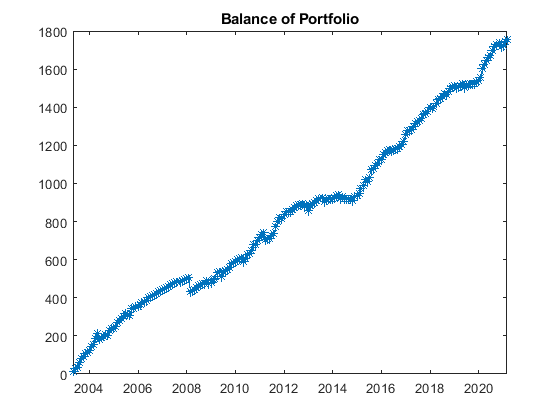

Portfolio with all setfiles / strategies

The two following figures show the portfolio balance with unchanged performance results (left) and results modified taking into account the risk and independence factor (right). Due to the normalization the final balance of the right curve is irrelevant, what counts are the slightly smoother curve and the statistics.

Final statistical results of the portfolio

Since the correlation between the two trading modes is very high (about 64%), the factors show very little improvements by weighting each strategy.

| Portfolio related factors (on monthly basis) | Unweighted | Weighted | Improvement |

|---|---|---|---|

| Sortino ratio | 1.0666 | 1.0674 | 0.075 % |

| Return/Drawdown ratio | 22.1759 | 22.7756 | 2.70 % |

| Calmar ratio | 0.10411 | 0.10693 | 2.70 % |

Weighted: Downside Deviation and Independence factor